Aarp Federal Income Tax Calculator 2025. Enter your income and location to estimate your tax burden. Tax brackets for 2025 escient financial, the standard deduction for married couples filing jointly for tax year 2025 rises to $29,200, an increase.

Aarp money map™ budget builder. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

2025 Federal Tax Brackets And Rates Rasla Cathleen, Federal, state & local taxes. Us irs tax brackets 2025.

Federal Tax Brackets 2025 Calculator Vonni Johannah, 2025 united states federal personal income taxes payment estimator. Calculate your federal, state and local taxes.

How To Calculate Federal Tax 2025 Sibyl Deloris, The top marginal income tax rate of 37. Page last reviewed or updated:

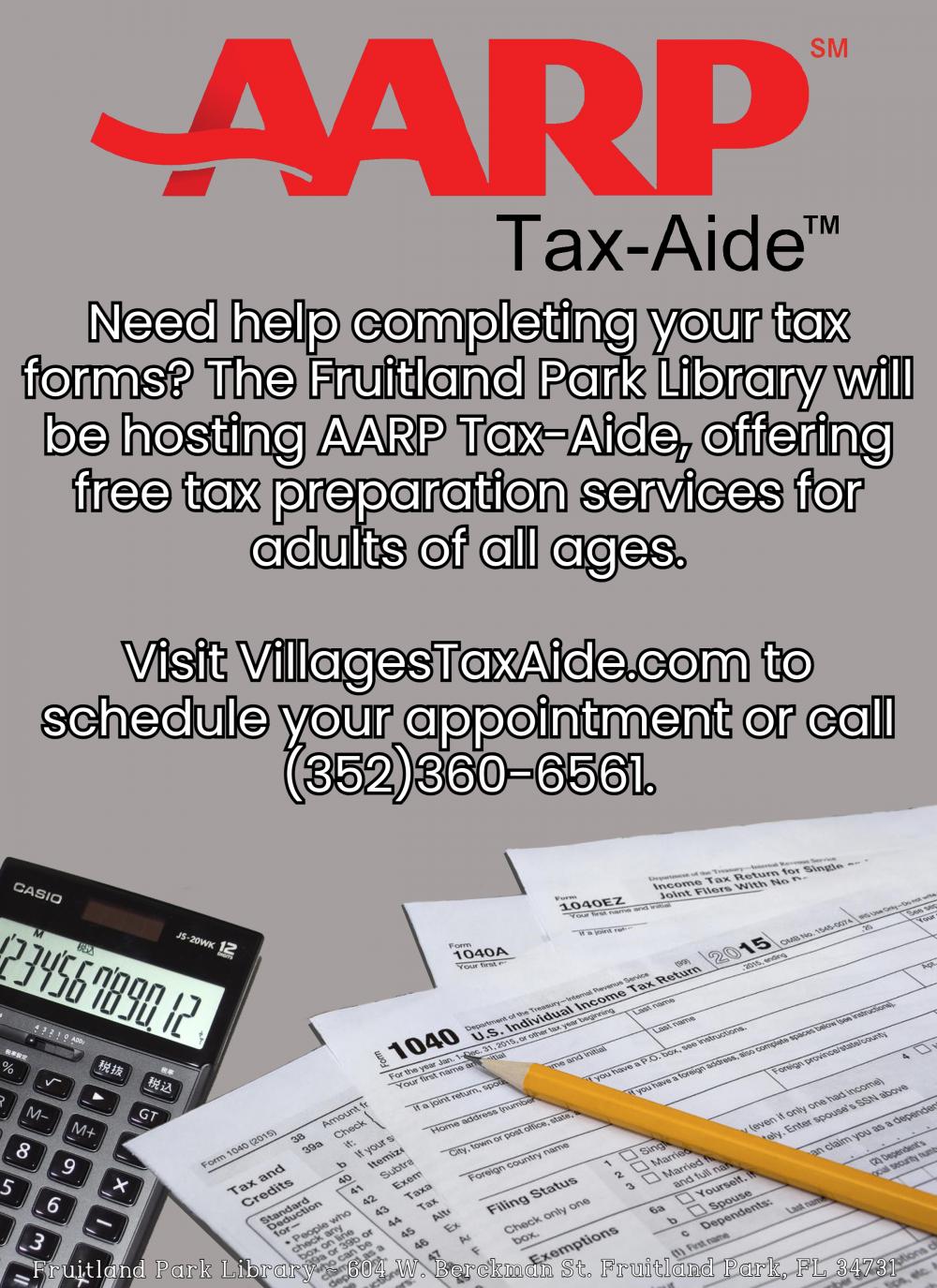

AARP TaxAide City of Fruitland Park Florida, Based on your projected tax withholding for the year, we can. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and.

Federal Tax Calculator 202424 Casey Cynthea, Estimate your potential bill or refund with our free income tax calculator. Calculate your federal, state and local taxes for the current filing year with our free income tax calculator.

What Are Federal Tax Rates For 2025 Lory Silvia, Tax brackets for 2025 escient financial, the standard deduction for married couples filing jointly for tax year 2025 rises to $29,200, an increase. Federal, state & local taxes.

Tax rates for the 2025 year of assessment Just One Lap, Estimate your potential bill or refund with our free income tax calculator. Calculate your federal, state and local taxes for the current filing year with our free income tax calculator.

IRS Sets 2025 Tax Brackets with Inflation Adjustments, It is mainly intended for residents of the u.s. 2025 income tax brackets and tax rate calculator.

Federal Tax Calculator How to Estimate Your Taxes? Federal, The top marginal income tax rate of 37. Estimate your potential bill or refund with our free income tax calculator.

How To Calculate Federal Tax Rate In Excel TAX, Federal, state & local taxes. Home > state tax > california.

Tax brackets for 2025 escient financial, the standard deduction for married couples filing jointly for tax year 2025 rises to $29,200, an increase.

DIY Tutorials WordPress Theme By WP Elemento